UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

The TJX Companies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

|

770 Cochituate Road

Framingham, Massachusetts 01701

April 27, 201224, 2014

Dear Fellow Stockholder:

We cordially invite you to attend our 20122014 Annual Meeting on Wednesday,Tuesday, June 13, 2012,10, 2014, at 11:9:00 a.m. (local time)(Mountain Standard Time), to be held at our offices, 770 Cochituate Road, Framingham, Massachusetts. Please enter through the Northeast Entrance.Phoenix Chase Tower Conference Center, 201 N. Central Avenue, Phoenix, Arizona 85004.

The proxy statement accompanying this letter describes the business we will consider at the meeting. Your vote is important regardless of the number of shares you own. Please read the proxy statement and vote your shares. Instructions for Internet and telephone voting are attached to your proxy card. If you prefer, you can vote by mail by completing and signing your proxy card and returning it in the enclosed pre-paid return envelope.

We hope that you will be able to join us on June 13th.10th.

Sincerely,

|  | |||

| Bernard Cammarata | Carol Meyrowitz | |||

| Chairman of the Board | Chief Executive Officer | |||

Printed on Recycled Paper

| 1 | ||||

| 2 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 21 | ||||

| 23 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 35 | ||||

| 37 | ||||

Option Exercises and Stock Awards Vested during Fiscal | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 42 | ||||

| 42 | ||||

| 47 | ||||

| 48 | ||||

PROPOSAL 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

The TJX Companies, Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 13, 201210, 2014

The Annual Meeting of Stockholders of The TJX Companies, Inc. will be held at our offices, 770 Cochituate Road, Framingham, Massachusetts,the Phoenix Chase Tower Conference Center, 201 N. Central Avenue, Phoenix, Arizona, on Wednesday,Tuesday, June 13, 2012,10, 2014, at 11:9:00 a.m. (local time)(Mountain Standard Time) to vote on:

Election of directors

Ratification of appointment of our independent registered public accounting firm

Approval of the material terms of executive officer performance goals under our cash incentive plans for fiscal 2015

Advisory approval of TJX’s executive compensation (the “say-on-pay vote”)

Any other business properly brought before the meeting

Stockholders of record at the close of business on April 16, 201214, 2014 are entitled to notice of, and entitled to vote at, the Annual Meeting and any adjournments or postponements thereof.

To attend the Annual Meeting, you must demonstrate that you were a TJX stockholder at the close of business on April 16, 201214, 2014 or hold a valid proxy for the Annual Meeting from such a stockholder. If you are not a stockholder of record but hold shares through a broker, trustee or nominee, you will need to bring proof of your beneficial ownership as of April 16, 2012,14, 2014, such as a brokerage account statement showing your ownership on that date or similar evidence of ownership. All stockholders will need to check in upon arrival and receive visitorattendee badges for building security.security purposes. Please allow additional time for these procedures.

By Order of the Board of Directors

Ann McCauley

Secretary

Framingham, Massachusetts

April 27, 201224, 2014

YOUR VOTE IS IMPORTANT.

PLEASE VOTE ONOVER THE INTERNET, BY TELEPHONE OR BY MAIL

The TJX Companies, Inc.

ANNUAL MEETING OF STOCKHOLDERS

June 13, 201210, 2014

The Board of Directors of The TJX Companies, Inc., or TJX, is soliciting your proxy for the 20122014 Annual Meeting. A majority of the shares outstanding and entitled to vote at the meeting is required for a quorum for the meeting.

You may vote onover the Internet, using the procedures and instructions described on the proxy card and other enclosures. You may vote by telephone using the toll-free telephone number provided on the proxy card. The process for Internet and telephone voting includes easy-to-follow instructions and is designedintended to authenticate your identity and permit you to confirm that your voting instructions are accurately reflected. StreetIf you are a stockholder of record, you may also vote by signing and returning the enclosed proxy card. If you are a street name holders (whoholder and hold theiryour shares through a third party, like a bank or broker)broker, you may vote byaccording to the instructions (which may include Internet or telephone if their banksvoting) provided by the bank or brokers make those methods available, in which case the banks or brokers will enclose the relevant instructionsbroker with the proxy statement. All stockholders of record may vote by signing and returning the enclosed proxy card.

You may revoke your proxy at any time before it is voted at the annual meetingAnnual Meeting by voting later by telephoneInternet or Internet,telephone, returning a later-dated proxy card, or delivering a written revocation to the Secretary of TJX. Our address isTJX at our corporate offices at 770 Cochituate Road, Framingham, Massachusetts 01701.

Stockholders of record at the close of business on April 16, 201214, 2014 are entitled to vote at the meeting. Each of the 741,678,724701,786,543 shares of common stock outstanding on the record date is entitled to one vote.

This proxy statement, the proxy card and the Annual Report to Stockholders for our fiscal year ended January 28, 2012February 1, 2014 (fiscal 2012)2014) are being first mailed to stockholders on or about the date of the notice of meeting, April 27, 2012.24, 2014.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting To Be Held on June 13, 2012: This proxy statement and Annual Report and FormIMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 10, 2014: THIS PROXY STATEMENT AND ANNUAL REPORT AND FORM 10-K for fiscal 2012 are available at http:FOR FISCAL 2014 ARE AVAILABLE AT

HTTP://bnymellon.mobular.net/bnymellon/tjxWWW.ENVISIONREPORTS.COM/TJX

ELECTION OF DIRECTORS

We seek nominees who have established strong professional reputations, sophistication and experience in the retail and consumer industries. We also seek nominees with experience in substantive areas that are important to our business such as international operations and growth; marketing and brand management; sales, buying and distribution; accounting, finance and capital structure; strategic planning and leadership of complex organizations; human resources and development practices; and strategy and innovation. Our nominees hold or have held senior executive positions in large, complex organizations or in businesses related to important substantive areas important to our business, and in these positions have also gained experience in core management skills and substantive areas relevant to our business. Our nominees also have experience working with or serving on boards of directors and board committees of other public companies, and each of our nominees has an understanding of corporate governance practices and trends. In addition, most of our nominees have significant prior service on our Board, which has provided them with significant exposure to both our business and the industry in which we compete. We believe that all our nominees possess the professional and personal qualifications necessary for board service and we have highlighted particularly noteworthy attributes for each director in the individual biographies below.

The 10 individuals listed below have been nominated and are standing for election at this year’s Annual Meeting. If elected, they will hold office until our 20132015 Annual Meeting of Stockholders and until their successors are duly elected and qualified. Other than Mr. Abdalla, who was elected by the Board in January 2012, allAll of our nominees are current directors and were elected to the Board by our stockholders.

Your Board of Directors unanimously recommends that you vote FOR the election of each of the nominees as director.director.

Zein Abdalla, 5355

Director since 2012

Mr. Abdalla has been CEO of PepsiCo Europe, a divisionPresident of PepsiCo, Inc., a leading global food, snack and beverage company, since November 2009,September 2012, prior to which he served as CEO of PepsiCo Europe, a division of PepsiCo, starting in November 2009 and as President, PepsiCo Europe Region starting in January 2006. Mr. Abdalla previously held a variety of senior positions at PepsiCo since he joined that company in 1995, including as General Manager of PepsiCo’s European Beverage Business, General Manager of Tropicana Europe and Franchise Vice President for Pakistan and the Gulf region. Mr. Abdalla’s executive experience with a large global company has given him expertise in corporate management, including in emerging markets, operations, brand management, distribution and global strategy.

José B. Alvarez, 4951

Director since 2007

Mr. Alvarez has been a member of the faculty of the Harvard Business School since 2009. From August 2008 through December 2008, Mr. Alvarez was the Global Executive Vice President for Business Development for Ahold, a global supermarket retail company. From 2001 to August 2008, he held various executive positions with Stop & Shop/Giant-Landover, Ahold’s U.S. subsidiary, including President and Chief Executive Officer of Stop & Shop/Giant-Landover from 2006 to 2008 and Executive Vice President, Supply Chain and Logistics from 2004 to 2006. Previously, he served in executive positions at Shaw’s Supermarkets, Inc. and began his career at the Jewel Food Stores subsidiary of American Stores Company in 1990. Mr. Alvarez is also a director of United Rentals, Inc. and served on the board of Church & Dwight Co., Inc. from 2011 until 2013. Mr. Alvarez’s long career in retail has given him broad experience in large retail chain management, including store management, supply chain, logistics, distribution and strategy.

2

Alan M. Bennett, 6163

Director since 2007

Mr. Bennett served as the Chief Executive Officer of H&R Block Inc., a tax services provider, from July 2010 to May 2011 and was previously Interim Chief Executive Officer from November 2007 through August 2008. He

was Senior Vice President and Chief Financial Officer and a Member of the Office of the Chairman of Aetna, Inc., a diversified healthcare benefits company, from 2001 to 2007, and previously held other senior financial management positions at Aetna after joining in 1995. Mr. Bennett held various senior management roles in finance and sales/marketing at Pirelli Armstrong Tire Corporation, formerly Armstrong Rubber Company, from 1981 to 1995 and began his career with Ernst & Ernst (now Ernst & Young LLP). Mr. Bennett is also a director of Halliburton Company and Fluor Corporation and was a director of H&R Block from 2008 to 2011 and Bausch & Lomb, Inc. from 2004 to 2007.2011. Mr. Bennett’s senior leadership roles in two significant financial businesses provide him with executive experience in managing very large businesses and change management as well as financial expertise including financial management, taxes, accounting, controls, finance and financial reporting.

Bernard Cammarata, 7274

Director since 1989

Mr. Cammarata has been Chairman of the Board of TJX since 1999. Mr. Cammarata served as Acting Chief Executive Officer of TJX from September 2005 to January 2007. He also led TJX and its former TJX subsidiary and T.J. Maxx Division from the organization of the business in 1976 until 2000, including serving as Chief Executive Officer and President of TJX, Chairman and President of TJX’s T.J. Maxx Division and Chairman of The Marmaxx Group (Marmaxx). As the founder of TJX, Mr. Cammarata has participated in the leadership of TJX’s successful strategy and development from the beginning to its current position as the world’s largest off-price retailer and offers deep expertise in all aspects of TJX’s business, including management, operations, marketing, buying, distribution and financial matters.

David T. Ching, 5961

Director since 2007

Mr. Ching has beenwas Senior Vice President and Chief Information Officer for Safeway Inc., a food and drug retailer, from 1994 to January 2013 and has consulted through DTC Associates LLC, focusing on management consulting and technology services, since 1994.2013. Previously, Mr. Ching was the General Manager for British American Consulting Group, a software and consulting firm focusing on the distribution and retail industry. He also worked for Lucky Stores Inc., a subsidiary of American Stores Company from 1979 to 1993, including serving as the Senior Vice President of Information Systems. Mr. Ching was a director of Petco Animal Supplies, Inc. from 2005 to 2007. Mr. Ching’s strong technological experience and related management positions in the retail industry provide Mr. Ching expertise including information systems, information security and controls, technology implementation and operation, reporting and distribution in the retail industry.

Michael F. Hines, 5658

Director since 2007

Mr. Hines served as Executive Vice President and Chief Financial Officer of Dick’s Sporting Goods, Inc., a sporting goods retailer, from 1995 to March 2007. From 1990 to 1995, he held management positions with Staples, Inc., an office products retailer, most recently as Vice President, Finance. Mr. Hines spent 12 years in public accounting, the last eight years with the accounting firm Deloitte & Touche LLP. Mr. Hines is also a director of GNC Holdings, Inc. and Dunkin’ Brands Group, Inc. and was a director of The Yankee Candle Company, Inc. from 2003 to 2007. Mr. Hines’ experience as a financial executive and certified public accountant provides him with expertise in the retail industry including accounting, controls, financial reporting, tax, finance, risk management and financial management.

3

Amy B. Lane, 5961

Director since 2005

Ms. Lane was a Managing Director and Group Leader of the Global Retailing Investment Banking Group at Merrill Lynch & Co., Inc., from 1997 until her retirement in 2002. Ms. Lane previously served as a Managing Director at Salomon Brothers, Inc., where she founded and led the retail industry investment banking unit.

Ms. Lane is a director of GNC Holdings, Inc. and was also a director of Borders Group, Inc. from 1995 to 1999 and from 2001 to 2009. Ms. Lane’s experience as the leader of two investment banking practices covering the global retailing industry has given her substantial experience with financial services, capital markets, finance and accounting, capital structure, acquisitions and divestitures in that industry as well as management, leadership and strategy.

Carol Meyrowitz, 5860

Director since 2006

Ms. Meyrowitz has been Chief Executive Officer of TJX since January 2007, a director since September 2006 and also served as President from October 2005 to January 2011. She served as Senior Executive Vice President of TJX from 2004 until January 2005, Executive Vice President of TJX from 2001 to 2004 and President of Marmaxx from 2001 to January 2005. From January 2005 until October 2005, she was employed in an advisory role for TJX and consulted for Berkshire Partners LLC, a private equity firm. From 19871983 to 2001, she held various senior management and merchandising positions with Marmaxx and with Chadwick’s of Boston and Hit or Miss, former divisions of TJX. Ms. Meyrowitz is also a director of Amscan Holdings, Inc. and Staples, Inc. and was a director of The Yankee Candle Company,Amscan Holdings, Inc. from 20042005 to 2007.2012. As Chief Executive Officer of the Company, and through the many other positions Ms. Meyrowitz has held with TJX, since joining in 1987, Ms. Meyrowitz has a deep understanding of TJX and broad experience in all aspects of off-price retail, including innovation, strategy, buying, distribution, marketing, real estate, finance and accounting, and international operations.

John F. O’Brien, 6971

Director since 1996

Mr. O’Brien is the retired Chief Executive Officer and President of Allmerica Financial Corporation (now The Hanover Insurance Group, Inc.), an insurance and diversified financial services company, holding those positions from 1995 to 2002. Mr. O’Brien previously held executive positions at Fidelity Investments, an asset management firm, including Group Managing Director of FMR Corporation, Chairman of Institutional Services Company and Chairman of Brokerage Services, Inc. Mr. O’Brien serves as our Lead Director. Mr. O’Brien is also non-executive Chairman and a director of Cabot Corporation, a director of LKQ Corporation and a director of a family of 35 registered investment companiesmutual funds managed by BlackRock, Inc., an investment management advisory firm. Mr. O’Brien has substantial executive experience with two financial services businesses, giving him expertise including general management and oversight with respect to strategy, financial planning, insurance, operations, finance and capital structure.

Willow B. Shire, 6466

Director since 1995

Ms. Shire has been an executive consultant with Orchard Consulting Group since 1994, specializing in leadership development and strategic problem solving. Previously, she was Chairperson for the Computer Systems Public Policy Project within the National Academy of Science. She also held various positions at Digital Equipment Corporation, a computer hardware manufacturer, for 18 years, including Vice President and Officer, Health Industries Business Unit. Ms. Shire was a director of Vitesse Semiconductor Corporation from 2007 to 2009. Through her consulting experience and prior business experience, Ms. Shire brings expertise in leadership development, talent assessment, change management, human resources and development practices, cultural assessment and strategic problem solving.

4

Integrity has been a core tenet of TJX since itsour inception. We seek to perform with the highest standards of ethical conduct and in compliance with all laws and regulations that relate to our businesses. We have Corporate Governance Principles, a Global Code of Conduct for our Associates, a Code of Ethics for TJX Executives, written charters for each of our Board committees and a Director Code of Business Conduct and Ethics. The current versions of these documents and other items relating to our governance can be found atwww.tjx.com.on our corporate website, www.tjx.com, as described below in “Online Availability of Information.”

Independence Determination. Our Corporate Governance Principles provide that at least two-thirds of the members of our Board will be independent directors. The Board evaluates any relationships of each director and nominee with TJX and makes an affirmative determination whether or not each director and nominee is independent. To assist it in making its independence determination, the Board has adopted categorical standards, which are available in our Corporate Governance Principles on our website, atwww.tjx.com.

As part of the Board’s annual review of director independence, the Board considered the recommendation of our Corporate Governance Committee and reviewed any transactions and relationships between each non-management director or any member of his or her immediate family and TJX. The purpose of this review was to determine whether there were any such relationships or transactions and if so, whether they were inconsistent with a determination that the director was independent.

As a result of this review, our Board unanimously determined that eightnine directors of our 10-membercurrent 11-member Board (80%(82%) are independent: Zein Abdalla, José B. Alvarez, Alan M. Bennett, David T. Ching, Michael F. Hines, Amy B. Lane, Dawn Lepore, John F. O’Brien and Willow B. Shire. The same determination was made previously with respect to David A. Brandon and Fletcher H. Wiley, who each served on the Board until June 2011. Each of these directors met our categorical standards of independence. Bernard Cammarata, as Chairman, and Carol Meyrowitz, as Chief Executive Officer, are employed by TJX.TJX and are therefore not independent. Ms. Lepore is not standing for re-election at the annual meeting.

Board Nominations. The Corporate Governance Committee recommends to the Board individuals asto be director nominees who, in the opinion of the Corporate Governance Committee, have high personal and professional integrity, who have demonstrated ability, perspective and judgment and who will be effective in conjunction with the other nominees to and members of the Board, in collectively serving the long-term best interests of our stockholders. As described further in “Board Expertise and Diversity,” the Committee considers a range of factors when considering individual candidates, including professional experience, personal integrity and potential contributions to the Board as a whole. In addition, the Corporate Governance Committee considers each director nominee’s experience, qualifications, attributes and skills in light of our business, including those that are identified in the biographical information contained under “Election of Directors.”

The Corporate Governance Committee’s process for identifying and evaluating candidates, including candidates recommended by stockholders, includes actively seeking to identify qualified individuals by various means that may include reviewing lists of possible candidates, such as chief executive officers of public companies or leaders of finance or other industries; considering proposals from a range of sources, such as the Board of Directors, management, Associates, stockholders and industry contacts; and engaging a third-party search firm to expand our search and assist in compiling information about possible candidates.

The Corporate Governance Committee has a policy with respect to submission by stockholders of candidates for director nominees which is available on our website. Any stockholder may submit in writing one candidate for consideration for each stockholder meeting at which directors are to be elected by not later than the

5

120th calendar day before the first anniversary of the date that we released our proxy statement to stockholders in connection with the previous year’s Annual Meeting. Recommendations should be sent to the Secretary of TJX, The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701. A recommendation must include specified information about, and consents and agreements of, the candidate, as described in the policy. The Corporate Governance Committee evaluates candidates for the position of director recommended by stockholders or others in the same manner as candidates from other sources. The Corporate Governance Committee will determine whether to interview any candidates and may seek additional information about candidates from third-party sources.

Board Expertise and Diversity. As a global company with approximately 191,000 Associates at our fiscal year end, we consider diversity among our Associates, customers and vendors to be part of who we are and core to our culture. At the Board level and throughout the organization we strive to promote the benefits of leveraging differences and promoting a talented and diverse workforce. We seek to have a Board that represents diversity as to experience, gender and ethnicity/race and that reflects a range of talents, ages, skills, viewpoints, professional experience, educational background and expertise to provide sound and prudent guidance on our operations and interests. In evaluating the suitability of individual Board nominees, the Corporate Governance Committee does not have a formal policy with respect to diversity, but takes into account many factors, including general understanding of disciplines relevant to the success of a large publicly traded company in today’s business environment, understanding of our business and industry, professional background and leadership experience, experience on the boards of other large publicly traded companies, personal accomplishment, independence and geographic, gender, age, ethnic and racial diversity. The Corporate Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that the Committee believes can best perpetuate the success of our business and representrepresents stockholder interests through the exercise of sound judgment using its collective diversity of experience. In addition, the Corporate Governance Committee considers, in light of our business, each director nominee’s experience, qualifications, attributes and skills that are identified in the biographical information contained under “Election of Directors.”

The Corporate Governance Committee’s process for identifying and evaluating candidates, including candidates recommended by stockholders, includes actively seeking to identify qualified individuals by various means which may include reviewing lists of possible candidates, such as chief executive officers of public companies or leaders of finance or other industries; considering proposals from sources, such as the Board of Directors, management, Associates, stockholders and industry contacts; and engaging a third-party search firm to expand our search and assist in compiling information about possible candidates. During fiscal 2012, Mr. Abdalla was recommended to the Corporate Governance Committee by a third-party search firm.

The Corporate Governance Committee has a policy with respect to submission by stockholders of candidates for director nominees which is available on our website atwww.tjx.com. Any stockholder may submit in writing one candidate for consideration for each stockholder meeting at which directors are to be elected by not later than the 120th calendar day before the first anniversary of the date that we released our proxy statement to stockholders in connection with the previous year’s annual meeting. Recommendations should be sent to the Secretary of TJX, c/o Office of the Secretary of The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701. A recommendation must include specified information about, and consents and agreements of, the candidate, as described in the policy. The Corporate Governance Committee evaluates candidates for the position of director recommended by stockholders or others in the same manner as candidates from other sources. The Corporate Governance Committee will determine whether to interview any candidates and may seek additional information about candidates from third-party sources.

Board Expertise and Diversity. We seek to have a Board that represents diversity as to experience, gender and ethnicity/race, but we do not have a formal policy with respect to diversity. We also seek to have a Board that reflects a range of talents, ages, skills, viewpoints, professional experience, educational background and expertise to provide sound and prudent guidance with respect to our operations and interests. All of our directors are financially literate, and two members of our Audit Committee are audit committee financial experts. We value the many kinds of diversity reflected in our Board and nominees.

Majority VotingVoting.. Our by-laws provide for the election of directors in an uncontested election by a majority of the shares properly cast at the meeting. Our Corporate Governance Principles available atwww.tjx.com, require any incumbent nominee for director to provide an irrevocable contingent resignation at or prior to election, effective only (a) if such director fails to receive the requisite majority vote in an uncontested election and (b) the Board accepts such resignation. Our Corporate Governance Principles provide procedures for the consideration of such resignation by the Board. Within 90 days of the date of the annual meeting of stockholders, the Board, with the recommendation of the Corporate Governance Committee, will act upon such resignation. In making its decision, the Board will consider the best interests of TJX and its stockholders and will take what it deems to be appropriate action. Such action may include accepting or rejecting the resignation or taking further measures to address those concerns that were the basis for the underlying stockholder vote.

Policies Relating to Board Service. It is our policy that no director shall be nominated who has attained the age of 75 prior to or on the date of his or her election. Under our Corporate Governance Principles, directors who are CEOs of public companies should not serve on more than two boards of public companies besides their own and no director should serve on more than five boards of public companies. Under our Audit Committee Charter, members of the Audit Committee should not serve on more than two audit committees of other companies. When a director’s principal occupation or business association changes during his or her tenure as a director, our Corporate Governance Principles provide that the director is required to tender his or her resignation from the Board, and the Corporate Governance Committee will recommend to the Board any action to be taken with respect to the resignation.

Board AttendanceAttendance.. During fiscal 2012,2014, our Board met 10eight times. Each of our directors attended at least 75% of all meetings of the Board and committees of which he or she was then a member. At each regularly

6

scheduled Board meeting, the independent directors also met separately. It is our policy, included in our Corporate Governance Principles, that all nominees and directors standing for election are expected to attend the annual meeting of stockholders. All nine of our nominees and directors who stood for election at the 2013 Annual Meeting were then serving on our Board attended the 2011 Annual Meeting.in attendance.

The Board of Directors has five standing committees: Audit, Corporate Governance, Executive, Executive Compensation and Finance. Each committee’s charter is available on our website, atwww.tjx.com.www.tjx.com.

All members of the Audit, Corporate Governance, Executive Compensation and Finance Committees are independent directors. While each committee has designated responsibilities, the committeeseach committee may act on behalf of the entire Board. The committees regularly report on their activities to the entire Board.

The table below provides information about membership and meetings of these committees during fiscal 2012:2014:

Name | Audit | Corporate Governance | Executive | Executive Compensation | Finance | Audit | Corporate Governance | Executive | Executive Compensation | Finance | ||||||||||||||||||||

Zein Abdalla | X | |||||||||||||||||||||||||||||

José B. Alvarez | X | X | X | X | ||||||||||||||||||||||||||

Alan M. Bennett | X | X | * | X | X* | X | ||||||||||||||||||||||||

David A. Brandon** | X | * | X | |||||||||||||||||||||||||||

Bernard Cammarata | X | * | X* | |||||||||||||||||||||||||||

David T. Ching | X | X | X | X | ||||||||||||||||||||||||||

Michael F. Hines | X | * | X | X* | X | |||||||||||||||||||||||||

Amy B. Lane | X | X | X | * | X | X | X* | |||||||||||||||||||||||

Dawn Lepore+ | X | |||||||||||||||||||||||||||||

Carol Meyrowitz | ||||||||||||||||||||||||||||||

John F. O’Brien | X | X | X | X | ||||||||||||||||||||||||||

Willow B. Shire | X | * | X | X* | X | |||||||||||||||||||||||||

Fletcher H. Wiley** | X | X | ||||||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||

Number of meetings during fiscal 2012 | 11 | 3 | 0 | 7 | 4 | |||||||||||||||||||||||||

|

|

|

|

| ||||||||||||||||||||||||||

Number of meetings during fiscal 2014 | 10 | 4 | 0 | 6 | 5 | |||||||||||||||||||||||||

| * |

Audit Committee. The Audit Committee is directly responsible for the annual appointment, compensation, retention and oversight of the independent registered public accounting firm and oversight of the financial reporting process. Each member of the Audit Committee is a non-employee director and meets the independence standards adopted by the Board in compliance with New York Stock Exchange (NYSE) listing standards. The Audit Committee operates under the terms of a written charter which is reviewed by members of the committee annually. Specifically, the Audit Committee’s responsibilities include:include, among other things:

reviewing with management, internal auditors and the independent registered public accounting firm our quarterly and annual financial statements, including the accounting principles and procedures applied in their preparation and any changes in accounting policies;

monitoring our system of internal financial controls and accounting practices;

overseeing the internal and external audit process, including the scope and implementation of the annual audit;

overseeing our compliance and ethics programs;

7

selecting, or terminatingretaining, approving the compensation of, overseeing and if necessary, replacing the independent registered public accounting firm, approving their compensation and evaluating the performance of the independent registered public accounting firm, including the lead audit and reviewing partners;partner;

establishing and maintaining procedures for receipt, retention and treatment of complaints, including the confidential and anonymous submission of complaints by employees, regarding accounting or auditing matters;

pre-approving all work by the independent registered public accounting firm; and

reviewing other matters as the Board deems appropriate.

In addition to assuring the regular rotation of the lead partner of the independent auditor, as required by law, the Audit Committee, including its Chair, has been involved in the selection of, and reviews and evaluates the performance of, the independent auditor, including the lead audit partner, and further considers whether there should be regular rotation of the audit function among firms.

Executive Compensation Committee. The Executive Compensation Committee, or the ECC, is responsible for overseeing executive compensation and benefits. Each member of the ECC is a non-employee director and meets the independence standards adopted by the Board in compliance with New York Stock Exchangeand those required by NYSE listing standards. The ECC operates under the terms of a written charter which is reviewed by the members of the

committee annually. Pursuant to its charter, the ECC may delegate its authority to a subcommittee or to such other person that the ECC determines is appropriate and is permitted by law.applicable law, regulations and listing standards. Specifically, the ECC’s responsibilities include:include, among other things:

approving the compensation and benefits, including awards of stock options, bonuses and other awards and incentives, of our executive officers and other Associates in such categories as are from time to time identified by the ECC;

determining the compensation of the Chief Executive Officer, including awards of stock options, bonuses and other awards and incentives, based on the evaluation by the Corporate Governance Committee of the performance of the Chief Executive Officer and such other factors as the CommitteeECC deems relevant;

determining the performance goals and performance criteria under our incentive plans;

approving the terms of employment of our executive officers, including employment and other agreements with such officers;

reviewing and undertaking other matters that the Board or the ECC deems appropriate, such as the review of our succession plan for the CEOChief Executive Officer and other executive officers; and

overseeing the administration of our incentive plans.plans and other compensatory plans and funding arrangements.

The ECC also reviewedreviews our compensation policies and practices for our Associates to confirm thatdetermine whether they do not give rise to risks which are reasonably likely to have a material adverse effect on the Company.

Corporate Governance Committee. The Corporate Governance Committee is responsible for recommending nominees for directors to the Board and for our corporate governance practices. Each member of the Corporate Governance Committee is a non-employee director and meets the independence standards adopted by the Board in compliance with New York Stock ExchangeNYSE listing standards. The Corporate Governance Committee operates under the terms of a written charter which is reviewed by the members of the committee annually. Specifically, the Corporate Governance Committee’s responsibilities include:include, among other things:

recommending director nominees to the Board;

developing and reviewing corporate governance principles;

8

reviewing our policies with respect to corporate public responsibility, including charitable and political contributions and political advocacy;

reviewing practices and policies with respect to directors, including retirement policies, the size of the Board and the meeting frequency of the Board, and reviewing the functions, duties and composition of the committees of the Board and compensation for Board and committee members;

recommending processes for the annual evaluations of the performance of the Board, the Chairman, the Lead Director and each committee and its chair;

establishing performance objectives for the Chief Executive Officer and annually evaluating the performance of the Chief Executive Officer against such objectives; and

overseeing the maintenance and presentation to the Board of management’s plans for succession to senior management positions.

Executive Committee. The Executive Committee meets at such times as it determines to be appropriate and has the authority to act for the Board on specified matters during the intervals between meetings of the Board.

Finance Committee. The Finance Committee is responsible for reviewing and making recommendations to the Board relating to our financial activities and condition. The Finance Committee operates under the terms of a written charter which is reviewed by the members of the committee annually. Specifically, the Finance Committee’s responsibilities include:include, among other things:

reviewing and making recommendations to the Board with respect to our financing plans and strategies,strategies; financial condition,condition; capital structure,structure; tax strategies, liabilities and payments, dividends,payments; dividends; stock repurchase programs and insurance programs;

approving our cash investment policies, foreign exchange risk management policies, andcommodity hedging policies, capital investment criteria and agreements for borrowing by us and our subsidiaries from banks and other financial institutions; and

reviewing investment policies as well as the performance and actuarial status of our pension and other retirement benefit plans.

Board Leadership Structure and Role in Risk Oversight

Board Leadership StructureStructure.. Our Board annually elects a Chairman of the Board of Directors. The Board has chosen to separate the roles of Chairman and Chief Executive Officer. Consistent with our Corporate Governance Principles, because our current Chairman, Bernard Cammarata, is not independent, our independent directors have elected a Lead Director, John F. O’Brien. In thishis role as Lead Director, among other duties, Mr. O’Brien O’Brien:

meets at least quarterly with Carol Meyrowitz, our Chief Executive Officer, and with other senior officers as necessary, necessary;

attends regular management business review meetings, meetings;

schedules meetings of the independent directors, presides at meetings of the Board at which the Chairman is not present, including meetings of the independent directors, directors;

serves as a liaison between the independent directors and the Chairman and Company management and approves meeting schedules and agendas, agendas;

attends the meetings of each Board committeecommittee; and

undertakes other responsibilities designated by the independent directors.

9

The Board believes that the separate roles of Mr. Cammarata, Ms. Meyrowitz and Mr. O’Brien are in the best interests of TJX and its stockholders. Mr. Cammarata has wide-ranging, in-depth knowledge of our business arising from his many years of service to TJX and, as a result, provides effective leadership for the Board and support for Ms. Meyrowitz and other management. The structure permits Ms. Meyrowitz to devote more of her attention to leading TJX and focus on the execution of its business strategy. Mr. O’Brien provides independence in TJX’s Board leadership as provided in the Corporate Governance Principles through his review and approval of Board meeting agendas, his participation in management business review meetings and his leadership of the independent directors.

Board’s Role in Risk Oversight. It is management’s responsibility to manage risk and bring to the Board’s attention risks that are material to TJX. The Board has oversight responsibility for the systems established to report and monitor the most significant risks applicable to TJX. The Board administers its risk oversight role directly and through its committee structure and the committees’ regular reports to the Board at Board meetings. In general terms:

The Board reviews strategic, financial and execution risks and exposures associated with the annual plan and multi-year plans, any major litigation and other matters that may present material risk to the Company’sour operations, plans, prospects or reputation, acquisitions and divestitures and senior management succession planning and receives regular reports from our Chief Compliance Officer and Director of Enterprise Risk.

The Audit Committee reviews risks associated with financial and accounting matters, including financial reporting, accounting, disclosure, internal controls over financial reporting, ethics and compliance programs, compliance with orders and data security.

The ECC reviews risks related to executive compensation and the design of compensation programs, plans and arrangements.

The Corporate Governance Committee deals withreviews risks related to boardBoard and CEO evaluations and management succession.

The Finance Committee is responsible forreviews risks related to financing, investment, capital structure and liquidity, and investment performance, asset allocation strategies and funding of our benefit plans.

Compensation Program Risk Assessment.As part of our regular enterprise risk assessment process overseen by the Board and described above, we review the risks associated with our compensation plans and arrangements. In fiscal 2012,2014, the ECC reviewed TJX’s employee compensation policies and practices and determined that they do not give rise to risks that are reasonably likely to have a material adverse effect on TJX. The ECC’s assessment considered (a) what risks could be created or encouraged by our executive and broad-based compensation plans and arrangements worldwide, (b) how those potential risks are monitored, mitigated and managed and (c) whether those potential risks are reasonably likely to have a material adverse effect on TJX. The assessment was led by our Chief Compliance Officer and Director of Enterprise Risk, whose responsibilitiesincluderesponsibilities include leadership of our enterprise risk management process, and included consultation with and input by, among others, executive officers, senior human resources and financial executives, the ECC’s independent compensation consultant and internal and external legal counsel. This process included:

a review of our compensation programs and practices, including our historical compensation practices;

analysis of programs or program features and practices that could potentially encourage excessive or unreasonable risk-taking of a material nature;

a review of business risks that these program features could potentially encourage;

identification of factors that mitigate risks to the business and incentives for executives to take excessive risk, including, among others, a review of compensation design and elements of the compensation programs,programs; the balance among these program elements,elements; role of compensation consultants and other advisors, authority and discretion of the Board, the ECC and other Board committees in compensation, controls and procedures, program and cultural elements and potential for individual or group influences; and

10

advisors; authority and discretion of the Board, the ECC and other Board committees in compensation; controls and procedures; program and cultural elements and potential for individual or group influences; and |

consideration of the balance of potential risks and rewards related to our compensation programs and its role in implementation of our corporate strategy.

Codes of Conduct and Ethics and Other Policies

Global Code of Conduct for AssociatesAssociates.. We have a Global Code of Conduct for our Associates designedthat requires our Associates to ensure thatconduct our business is conducted with integrity. Our Global Code of Conduct covers professional conduct, including employment policies, ethical business dealings, conflicts of interest, confidentiality, intellectual property rights and the protection of confidential information, as well as adherence to laws and regulations applicable to the conduct of our business. We have a Code of Conduct helpline to allow Associates to voice their concerns. We also have procedures for Associates to report complaints regarding accounting and auditing matters. Information about the helpline and reporting procedures are available on our website, atwww.tjx.com.www.tjx.com.

Code of Ethics for TJX Executives and Director Code of Business Conduct and EthicsEthics.. We have a Code of Ethics for TJX Executives governing our Chairman, Chief Executive Officer, President, Chief Financial Officer and other senior operating, financial and legal executives. The Code of Ethics for TJX Executives is designed to ensure integrity in our financial reports and public disclosures. We also have a Director Code of Business Conduct and Ethics whichthat promotes honest and ethical conduct, compliance with applicable laws, rules and regulations and the avoidance of conflicts of interest. We intend to disclose any future amendments to, or waivers from, the Code of Ethics for TJX Executives or the Director Code of Business Conduct and Ethics within four business days of the waiver or amendment through a website posting or by filing a Current Report on Form 8-K with the Securities and Exchange Commission, or SEC.

Stock Ownership Guidelines for Directors and Executives. Our Corporate Governance Principles provide that a director is expected to acquire initially at least $10,000 of our common stock outright and to attain stock ownership with a fair market value equal to at least five times the annual retainer paid to the directors within five years of initial election to the Board. OurAs described further in the Compensation Discussion and Analysis section, our Chief Executive Officer is expected to attain stock ownership with a fair market value equal to at least five times annual base compensation and our President, our Chief Financial Officer and each Senior Executive Vice President is expected to attain stock ownership with a fair market value of at least three times annual base compensation. SuchAt age 62, such ownership guidelines for our executive officers are reduced by 50% at age 62. Executives are expected to make steady progress toward these ownership guidelines and to attain them within five years from their respective dates of hire as or promotion to the above positions. It is expected that executives who have not yet achieved these guidelines will retain 50% of their shares (on an after-tax basis) resulting from the exercise of stock options and vesting of restricted and deferred stock.fifty percent.

Board Annual Performance ReviewsReviews.. We have a comprehensive review process for evaluating the performance of our Board and our directors. Our Corporate Governance Committee oversees the annual performance evaluation of the entire Board, our Chairman, our Lead Director, each of our committees and its chair, and each of our individual directors.

Environmental Sustainability. As part of our continued commitment to corporate responsibility, TJX has long pursued solutions to sustainability challengesinitiatives that are good for the environment as well as our profitability. We believe in the Company’s profitability.

We continue to be committed tovalue of environmentally sound business practices throughout our operations, including energy and water conservation as well as recycling and waste reduction.reduction efforts. We have discussed our effortsprograms with stockholder groups over the years and understand the importance of strong, sustainable business practices to our business, stockholders, Associates, customers and communities of strong, sustainable business practices.communities. Our corporate social responsibility report, which highlights efforts we have made in these initiatives, is available on our website,at www.tjx.com,. in the Corporate Responsibility section.

Online Availability of Information. The current versions of our Corporate Governance Principles, Global Associate Code of Conduct, Code of Ethics for TJX Executives, Director Code of Business Conduct and Ethics, and

11

charters for our Audit, Corporate Governance, Executive, Executive Compensation and Finance Committees are available on our website, atwww.tjx.com. in the Corporate Responsibility: Attention to Governance section. Information appearing on www.tjx.com is not a part of, and is not incorporated by reference in, this Proxy Statement.

Security holders and other interested parties may communicate directly with the Board, the non-management directors or the independent directors as a group, specified individual directors or the Lead Director by writing to such individual or group c/o Office of the Secretary, The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701. The Secretary will forward such communications to the relevant group or individual at or prior to the next meeting of the Board. Stockholders and others can communicate complaints regarding accounting, internal accounting controls or auditing matters by writing to the Audit Committee, c/o Vice President, Corporate Internal Audit Director, The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701.

Transactions with Related Persons

Under the Corporate Governance Committee’s charter, the Committee is responsible for reviewing and approving or ratifying any transaction in which TJX is a participant and any of our directors, director nominees, executive officers, 5% stockholders and their immediate family members is a participant and in which such person has a direct or indirect material interest as provided under SEC rules. In the course of reviewing potential related person transactions, the Corporate Governance Committee considers the nature of the related person’s interest in the transaction; the presence of standard prices, rates or charges or terms otherwise consistent with arms-length dealings with unrelated third parties; the materiality of the transaction to each party; the reasons for TJX entering into the transaction with the related person; the potential effect of the transaction on the status of a director as an independent, outside or disinterested director or committee member; and any other factors the Committee may deem relevant. Our General Counsel’s office is primarily responsible for the implementation of processes and procedures for screening potential transactions and providing information to the Corporate Governance Committee.

In April 2012, we acquired two office buildings in Marlborough, Massachusetts intended to be used as part of our corporate headquarters for an aggregate purchase price of approximately $62.5 million from affiliates of FMR LLC, which, with its related funds, beneficially owns more than 5% of our outstanding stock. We employ During fiscal 2014, Charles Barios, theBairos, brother-in-law of Ms. Meyrowitz, our CEO, as a Managerand Barbara House, sister-in-law of Technical Services. HeMr. Sherr, an executive officer, were employed by TJX. They received compensation from us, consistent with other Associates at his leveltheir respective levels and with his responsibilities, that totaledtotaling approximately $145,436$172,145 and $131,384, respectively, for fiscal 2012,2014, including salary and incentive compensation, and he participatescompensation. They each also participated in company benefit plans generally available to similarly situated Associates. Lisa Cammarata, daughter of Mr. Cammarata, our Chairman, is an executive and an owner of one of the vendors from which TJX acquires merchandise from time to time. Since the beginning of fiscal 2014, TJX purchased approximately $5.6 million in merchandise from that vendor. Our Corporate Governance Committee discussed and approved these transactions, consistent with our review process described above.

We operateThe Audit Committee operates in accordance with a written charter adopted by the Board and reviewed annually by the Committee. We are responsible for overseeing the quality and integrity of TJX’s accounting, auditing and financial reporting practices. The Audit Committee is composed solely of members who are independent, as defined by the New York Stock ExchangeNYSE and TJX’s Corporate Governance Principles. Further, the Board has determined that two of our members (Mr. Hines and Ms. Lane) are audit committee financial experts as defined by the rules of the SEC.

The Audit CommitteeWe met 1110 times during fiscal 2012,2014, including four meetings held with TJX’s Chief Financial Officer, Corporate Controller, Corporate Internal Audit and PricewaterhouseCoopers LLP, or PwC, TJX’s independent registered public accounting firm, prior to the public release of TJX’s quarterly and annual earnings announcements in order to discuss the financial information contained in the announcements. Management has

12

the responsibility for the preparation of TJX’s financial statements, and PwC has the responsibility for the audit of those statements.

We took numerous actions to discharge our oversight responsibility with respect to the audit process. We reviewed and discussed the audited financial statements of TJX as of and for fiscal 2014 with management and PwC. We received the written disclosures and the letter from PwC pursuant to Rule 3526, Communication with Audit Committees Concerning Independence,required by applicable requirements of the Public Company Accounting Oversight Board (PCAOB) regarding the independent accountant’s communications with the audit committee concerning any relationships between PwC and TJXindependence and the potential effects of any disclosed relationships on PwC’s independence and discussed with PwC its independence. We discussed with management, the internal auditors and PwC, TJX’s internal control over financial reporting and management’s assessment of the effectiveness of internal control over financial reporting and the internal audit function’s organization, responsibilities, budget and staffing. We reviewed with both PwC and our internal auditors their audit plans, audit scope and identification of audit risks.

We discussedreviewed and revieweddiscussed with PwC communications required by the Standards of the PCAOB (United States), as described in PCAOB AU Section 380,Auditing Standard 16, “Communication with Audit Committees,” and, with and without management present, discussed and reviewed the results of PwC’s examination of TJX’s financial statements. We also discussed the results of the internal audit examinations with and without management present.

The aggregate fees that TJX paid for professional services rendered by PwC for fiscal 2012 and fiscal 2011 were:

In thousands | 2012 | 2011 | ||||||

Audit | $ | 4,967 | $ | 4,377 | ||||

Audit Related | 295 | 415 | ||||||

Tax | 318 | 488 | ||||||

All Other | 22 | 12 | ||||||

|

|

|

| |||||

Total | $ | 5,602 | $ | 5,292 | ||||

|

|

|

| |||||

Audit fees were for professional services rendered for the audits of TJX’s consolidated financial statements including financial statement schedules and statutory and subsidiary audits, assistance with review of documents filed with the SEC, and opinions on the effectiveness of internal control over financial reporting with respect to fiscal 2012 and fiscal 2011.

Audit related fees were for services related to consultations concerning financial accounting and reporting standards and employee benefit plan and medical claims audits.

Tax fees were for services related to tax compliance, planning and advice, including assistance with tax audits and appeals, tax services for employee benefit plans, and requests for rulings and technical advice from tax authorities.

All other fees were for services related to training for TJX’s internal audit department in fiscal 2012 and fiscal 2011.

We pre-approve all audit services and all permitted non-audit services by PwC, including engagement fees and terms. We have delegated the authority to take such action between meetings to the Audit Committee chair, who reports the decisions made to the full Audit Committee at its next scheduled meeting.

Our policies prohibit TJX from engaging PwC to provide any services relating to bookkeeping or other services related to accounting records or financial statements, financial information system design and implementation, appraisal or valuation services, fairness opinions or contribution-in-kind reports, actuarial

services, internal audit outsourcing, any management function, legal services or expert services not related to the audit, broker-dealer, investment adviser, or investment banking services or human resource consulting. In addition, we evaluate whether TJX’s use of PwC for permitted non-audit services is compatible with maintaining PwC’s independence. We concluded that PwC’s provision of non-audit services, which we approved in advance, was compatible with their independence.

We reviewed and discussed the audited financial statements of TJX as of and for fiscal 2012 with management and PwC. Management has the responsibility for the preparation of TJX’s financial statements, and PwC has the responsibility for the audit of those statements.

Based on these reviews and discussions with management and PwC, we recommended to the Board that TJX’s audited financial statements be included in its Annual Report on Form 10-K for fiscal 20122014 for filing with the SEC. We also have selected PwC as the independent registered public accounting firm for fiscal 2013,2015, subject to ratification by TJX’s stockholders.

Audit Committee

Michael F. Hines,Chair

José B. Alvarez

David T. Ching

Amy B. Lane

The aggregate fees that TJX paid for professional services rendered by PwC for fiscal 2014 and fiscal 2013 were:

In thousands | 2014 | 2013 | ||||||

Audit | $ | 5,482 | $ | 5,106 | ||||

Audit Related | 403 | 398 | ||||||

Tax | 495 | 258 | ||||||

All Other | 227 | 197 | ||||||

|

|

|

| |||||

Total | $ | 6,607 | $ | 5,959 | ||||

Audit fees were for professional services rendered for the audits of TJX’s consolidated financial statements including financial statement schedules and statutory and subsidiary audits, assistance with review of documents filed with the SEC, and opinions on the effectiveness of internal control over financial reporting with respect to fiscal 2014 and fiscal 2013.

Audit related fees were for services related to consultations concerning financial accounting and reporting standards and employee benefit plan and medical claims audits.

13

Tax fees were for services related to tax compliance, planning and advice, including assistance with tax audits and appeals, tax services for employee benefit plans, and requests for rulings and technical advice from tax authorities.

All other fees were for services related to training for TJX’s internal audit department and advisory services in our on-going development of TJX’s conflict minerals program in compliance with Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act in fiscal 2014 and training for TJX’s internal audit department and services related to TJX’s acquisition of Sierra Trading Post in fiscal 2013.

The Audit Committee of the Board pre-approves all audit services and all permitted non-audit services by PwC, including engagement fees and terms. The Audit Committee has delegated the authority to take such action between meetings to the Audit Committee chair, who reports the decisions made to the full Audit Committee at its next scheduled meeting.

Our policies prohibit TJX from engaging PwC to provide any services relating to bookkeeping or other services related to accounting records or financial statements, financial information system design and implementation, appraisal or valuation services, fairness opinions or contribution-in-kind reports, actuarial services, internal audit outsourcing, any management function, legal services or expert services not related to the audit, broker-dealer, investment adviser, or investment banking services or human resource consulting. In addition, the Audit Committee evaluates whether TJX’s use of PwC for permitted non-audit services is compatible with maintaining PwC’s independence. The Audit Committee concluded that PwC’s provision of non-audit services, which were approved in advance, was compatible with their independence.

The following table shows, as of April 16, 2012,14, 2014, the number of shares of our common stock beneficially owned by each director, director nominee and executive officer named in the Summary Compensation Table and all directors and executive officers as a group. All share and share-based numbers in this proxy statement reflect the two-for-one stock split effected February 2, 2012.

Name | Number of Shares(1) | |||

Zein Abdalla | ||||

José B. Alvarez | ||||

Alan M. Bennett | ||||

Bernard Cammarata(2) | ||||

David T. Ching | ||||

Scott Goldenberg | 85,605 | |||

Ernie | ||||

Michael F. Hines | ||||

Amy B. | ||||

Dawn Lepore | 3,051 | |||

Michael MacMillan | 70,000 | |||

Carol Meyrowitz | ||||

| ||||

John F. O’Brien | ||||

| ||||

Willow B. Shire | ||||

| ||||

All Directors | ||||

14

The total number of shares beneficially owned by each individual and by the group above constitutes, in each constitutescase, less than 1% of the outstanding shares. Reflects sole voting and investment power except as indicated in footnotes below.

| (1) |

|

Include shares of common stock that the following persons had the right to acquire on April 14, 2014 or within 60 days thereafter through the exercise of options: Mr. Goldenberg 5,167; Mr. Herrman 194,528; Ms. Lane 8,500; Ms. Meyrowitz 273,493; Ms. Shire 24,000; and all directors and executive officers as a group 583,769.

Include performance-based restricted shares that were subject to forfeiture restrictions as of April 14, 2014: Mr. Goldenberg 71,000; Mr. Herrman 525,000; Mr. MacMillan 70,000; Ms. Meyrowitz 240,000; Mr. Sherr 115,000; and all directors and executive officers as a group 1,204,000. Shares listed do not include unvested performance-based deferred stock awards not scheduled to vest within 60 days of April 14, 2014.

| (2) |

| (3) |

| Includes 16,000 shares owned jointly and over which an executive officer and spouse share voting and dispositive power. |

The following table shows, as of April 16, 2012,14, 2014, each person known by us to be the beneficial owner of 5% or more of our outstanding common stock:

Name and Address of Beneficial Owner | Number of Shares | Percentage of Class Outstanding | Number of Shares | Percentage of Class Outstanding | ||||||||||||

FMR LLC 82 Devonshire Street Boston, MA 02109 | 95,850,314 | 12.71 | % | |||||||||||||

FMR LLC(1) | 81,776,919 | 11.5 | % | |||||||||||||

245 Summer Street | ||||||||||||||||

Boston, MA 02210 | ||||||||||||||||

The Vanguard Group(2) | 39,545,754 | 5.6 | % | |||||||||||||

100 Vanguard Blvd. | ||||||||||||||||

Malvern, PA 19355 | ||||||||||||||||

BlackRock, Inc.(3) | 36,185,071 | 5.1 | % | |||||||||||||

40 East 52nd Street | ||||||||||||||||

New York, NY 10022 | ||||||||||||||||

The amounts above are based on ownership of FMR LLC at December 31, 2011, as indicated in its Schedule 13G/A filed with the SEC on February 14, 2012, which reflected sole voting power with respect to 5,289,370 of the shares and sole dispositive power with respect to 95,850,314 shares.

| (1) | Amounts above based on ownership of FMR LLC at December 31, 2013 as indicated in its Schedule 13G/A filed with the SEC on February 14, 2014, which reflected sole voting power with respect to 5,382,419 of the shares and sole dispositive power with respect to 81,776,919 shares. |

| (2) | Amounts above based on ownership of The Vanguard Group at December 31, 2013 as indicated in its Schedule 13G/A filed with the SEC on February 12, 2014, which reflected sole voting power with respect to |

15

| 1,164,656 of the shares, sole dispositive power with respect to 38,458,346 shares and shared dispositive power over 1,087,408 shares. |

| (3) | Amounts above based on ownership of BlackRock, Inc. and certain subsidiaries at December 31, 2013 as indicated in its Schedule 13G/A filed with the SEC on February 4, 2014, which reflected sole voting with respect to 29,306,789 shares, shared voting power with respect to 52,167 shares, sole dispositive power with respect to 36,132,904 shares and shared dispositive power with respect to 52,167 of the shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers to file reports of holdings and transactions in our common stock with the SEC and the New York Stock Exchange.NYSE. To facilitate compliance, we have undertaken the responsibility to prepare and file these reports on behalf of our officers and directors. Based on our records and other information, all reports were timely filed.filed, other than a delay in filing a Form 4 to report transfers of shares for equivalent value to Mr. Cammarata from three family trusts.

16

Compensation Discussion and Analysis

Executive Summary

OverTJX is the last 10 years, ourleading off-price apparel and home fashions retailer in the United States and worldwide. Our management has led TJX’s excellentvery strong performance at TJX through weak and strong economies, more than doubling sales and earnings.economies. We believe our compensation program has been a key component to achieving this success and is critical to motivating our management to achieve our business goals encouragingand that a key component to our success is maintaining the ability to engage and develop new and existing talent to execute our business model and long-term, strategy, rewarding themglobal strategy.

To explain our program and to provide context for our named executive officers’ compensation, we begin with a brief executive summary with highlights of our strong fiscal 2014 performance and retaining them. Thean overview of key principles and elements of our compensation program. We then describe our process for making compensation decisions and detail specific elements of our compensation program and the fiscal 20122014 compensation of our named executive officers. Our named executive officers reflects our strong performance for the fiscal year.2014 were Carol Meyrowitz, Chief Executive Officer; Ernie Herrman, President; Michael MacMillan, Senior Executive Vice President, Group President, TJX Europe; Richard Sherr, Senior Executive Vice President, Group President, Marmaxx; and Scott Goldenberg, Executive Vice President, Chief Financial Officer.

OurTJX Performance Highlights

Fiscal 20122014 was another successful year for TJX.TJX, reflecting our management’s strong execution of our business model.

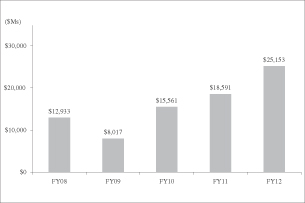

Our fiscal 2012We reached more than $27 billion in net sales, reached $23.2 billion, aabout 6% increase overmore than last year.

Our U.S. businesses continued to exceed our expectations in fiscal 2012, posting significant comparable store sales increases on top of significant increases in the prior two years and continuing to increase their segment profits. Our international businesses regained their momentum by the end of fiscal 2012.year (a 53-week year).

Our total stockholder return was 28% for fiscal 2012 was 43%.

Our performance continued to reflect strong execution by our management of our business model.

For the third consecutive fiscal year, we increased customer traffic.

We delivered another year of double digit earnings growth, with a 14% increase in adjusted earnings per share* in fiscal 2012,2014, on top of 23% and 48% increases in36% for the prior two years.

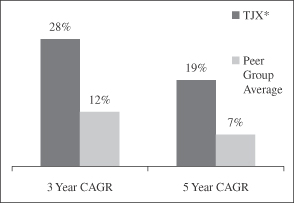

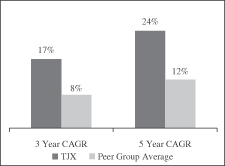

Our three- and five-year growth through fiscal 2012 surpassed that of our peer group.year before.

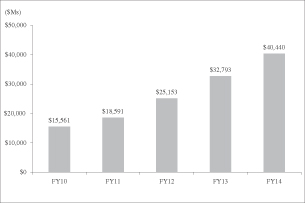

Our market capitalization continued to grow.grow, from $32.8 billion in fiscal 2013 to $40.4 billion at the end of fiscal 2014.

TJX Market Capitalization FY10 - FY14

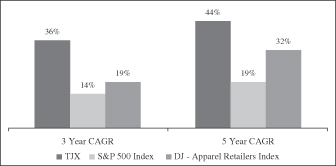

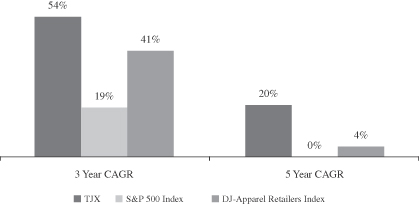

With this year’s performance, our three- and five-year compound annual growth rate for shareholder return exceeded the performance of the general market (S&P 500) and our industry index (Dow Jones U.S. Apparel Retailers Index). In the same periods our adjusted earnings per share surpassed that of our peer group members discussed in this Compensation Discussion and Analysis.

17

| ||

|   | |

| * |

|

| Computer Intrusion related costs from GAAP EPS of $1.04. |

As a result of our performance-based compensation program, our executives’Compensation for fiscal 2012 compensation2014 reflects our outstandingstrong performance.

WeOur fiscal 2014 performance exceeded our corporate pre-tax income-based target for fiscal 2012targets under our short-termannual cash incentive plan (MIP), resulting in a 117.95% payout of corporate short-term award opportunitiesabove target payouts for our named executive officers.officers (137.65% payout of corporate, 150.36% of TJX Europe and 134.61% of Marmaxx target awards).

Our company-wide performance for the cumulative fiscal 2010-2012 period substantially2012-2014 cycle exceeded the business plan-based targets for that three year periodour target performance under our long-term cash incentive plan and resulted(LRPIP), resulting in a 138.70%119.57% payout of award opportunitiestarget awards for our named executive officers.

We satisfied all of the performance-based vesting conditions ending in fiscal 20122014 for performance-based restricted stock and deferred stock awards (performance-based stock awards) held by our named executive officers.

Our stock price rose to $33.69 at fiscal year-end (on a post-split basis), a 41% increase over last fiscal year end.

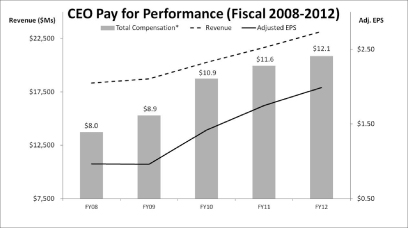

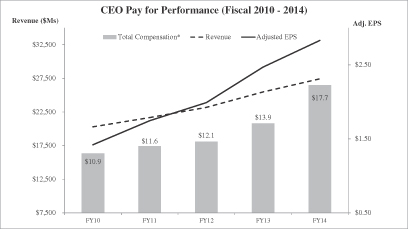

Our CEO’s earned compensation over the last five fiscal years iscontinued to be correlated with our strong performance:

| * | Total compensation for each fiscal year consists of base salary, |

18

Key Principles

| > | Our program is designed to be balanced, transparent and aligned with our business goals. |

| > | Our program is heavily weighted to at-risk incentive compensation with payout based on performance. |

| > | We seek to maintain shareholder-friendly pay practices and to align the interest of our Associates and shareholders. |

Our CompensationTJX Program Highlights

We have a total compensation approach focused on performance-based incentive compensation that seeks to:

attract and retain very talented individuals in the highly competitive retail environment, maintaining an extremely high talent level in our company and providing for succession broadly across our management;

reward objective achievement of the short- and long-term financial objectives reflected in our business plans; and

enhance shareholder value by directly aligning the interests of our management and shareholders.

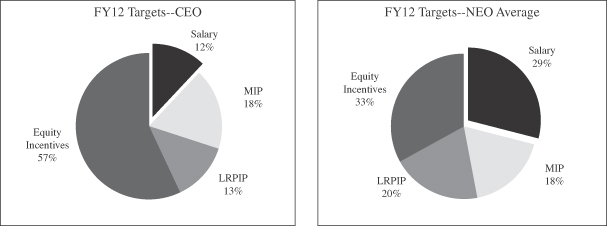

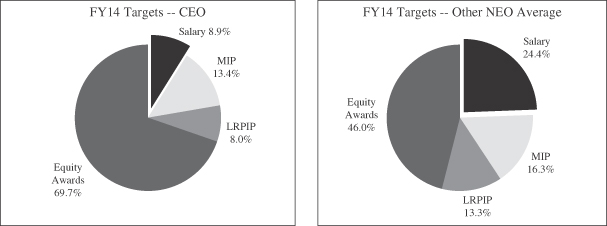

Our compensation program for our executives is heavily weighted to incentive compensation that is at risk. Base salary is the only one of the four principal elements of our compensation program that is fixed. Each of the other elements is variable: short- and long-term cash incentive plan awards are earned solely on thecompensation is tied directly to achievement of objective, Board-approved performance goals, vesting of performance-based restricted stock requires achievement of objective performance goals, and stock options have value only to the extent the value of our stock increases. As shown in the following charts, performance-based compensation (equity incentives, short-term cash incentives and long-term cash incentives) constituted a significant portion ofmetrics based on core business goals.

Incentive plan payouts for our named executive officers’ (NEOs) direct annualofficers can be decreased but not increased and are subject to limits on maximum payout.

Our stock awards for named executive officers have performance-based vesting conditions; none are solely time-based.

Our executive officers are subject to and are in compliance with published stock ownership guidelines.

Our named executive officers receive limited perquisites, quantified in the Summary Compensation Table.

We do not provide tax gross-ups on regular compensation at target in fiscal 2012.or golden parachute tax gross-ups (although we provide tax assistance under our global mobility program).

Fiscal 2012 Compensation Elements*

Severance benefits are payable to our named executive officers following a change of control only upon involuntary termination of employment or termination by the executive for “good reason.”

|

Elements of CompensationTJX Program Overview

Incentive compensation comprises a substantial portion of each named executive officer’s compensation opportunity. These incentives directly tieThe table below describes the amount of each named executive officer’s incentive compensation to objective performance achieved by TJX and its stock and thereby directly link executive compensation with the interests of our stockholders. The key elements of our compensation program for our named executive officers. All of these elements are shown below:intended to help us attract and retain talented individuals, in addition to the more specific objectives summarized below.

| Element | Objectives | Form | ||||

Salary | • | Provide a base level of compensation that reflects individual responsibilities | Cash | |||

• | Recognize individual performance | |||||

Annual Cash Incentives (MIP) | • | Incentivize performance to reach or exceed our short-term, annual financial objectives, primarily within each business division | Cash | |||

• | Reward achievement of financial goals for the current fiscal year, | |||||

|

| |||||

• | Balance our long-term performance goals | |||||

Long-Term Cash Incentives (LRPIP) | • | Incentivize performance to achieve our long-term financial objectives and foster teamwork across the company | Cash | |||

• | Reward company-wide achievement of multi-year financial goals (typically over three fiscal years) | |||||

| Balance our | |||||

• | Provide longer-term retention incentives | |||||